How to Buy a House with Bad Credit in 3 Straightforward Steps

It’s common to think that you aren’t able to buy a home if your credit is less than perfect, or even downright bad.

We are taught to believe that credit scores make or break you, and without a needle in the green on your credit tracker, you’re not ready to buy a house.

Our take? Credit is just one piece of a very large puzzle, especially when it comes to buying your first home.

Of course, credit scores are important. And if you have bad credit, plus you have trouble paying your bills, adding a mortgage isn’t the wisest decision.

Similarly, if you have limited or no credit history, building up your score a bit before you buy a home will save you a lot of money in interest every month. Plus, you can make credit score improvements fast.

On the other hand, if you’re in overall good financial shape, and you only have a couple of dings on your credit report from years ago that are dragging your score down? You should try to buy a home sooner rather than later.

Getting a mortgage now gives you two advantages: you get to benefit from the appreciation in your home’s value, and you can actually use your monthly mortgage payments to increase your score, refinancing at a later date to get better pricing.

Here’s what you need to know about buying a home with bad credit:

What is “bad credit” in the eyes of a mortgage lender?

You may be surprised at what a mortgage lender views as bad credit. You may assume you’ll get turned away if you have anything less than a 740.

In reality, bad credit does not automatically disqualify you from getting mortgage approval. It’s rare, but possible to buy a home with a credit score in the low to mid 500s.

What DOES a credit score do? It determines what types of mortgages you are eligible for and impacts your interest rate. It also could affect how much money the lender requires for a down payment. These factors influence your monthly mortgage payment and inform whether or not it’s a good financial move for you.

Credit score ranges and what you can qualify for

- 500+: this is the range to qualify for a Federal Housing Administration (FHA) loan.

- 620: this is the minimum credit score to qualify for most conventional mortgage loans.

- 640: this is around the typical credit score to qualify for VA and USDA loans, but many lenders have their own minimum requirements that may vary a bit.

Most mortgage applicants have a credit score between 670 and 740, and once your credit score is higher than that, there’s no real upside in the terms and conditions of your mortgage loan.

Beware: many credit tracking apps don’t use the same credit score as a mortgage lender.

It’s possible to show up and think your credit is a lot higher than it really is. This is because mortgage lenders use different credit scoring models than companies like Credit Karma. Your mortgage credit score is based on your FICO 2, 4, and 5, which can often be lower than your VantageScore (which many popular apps use).

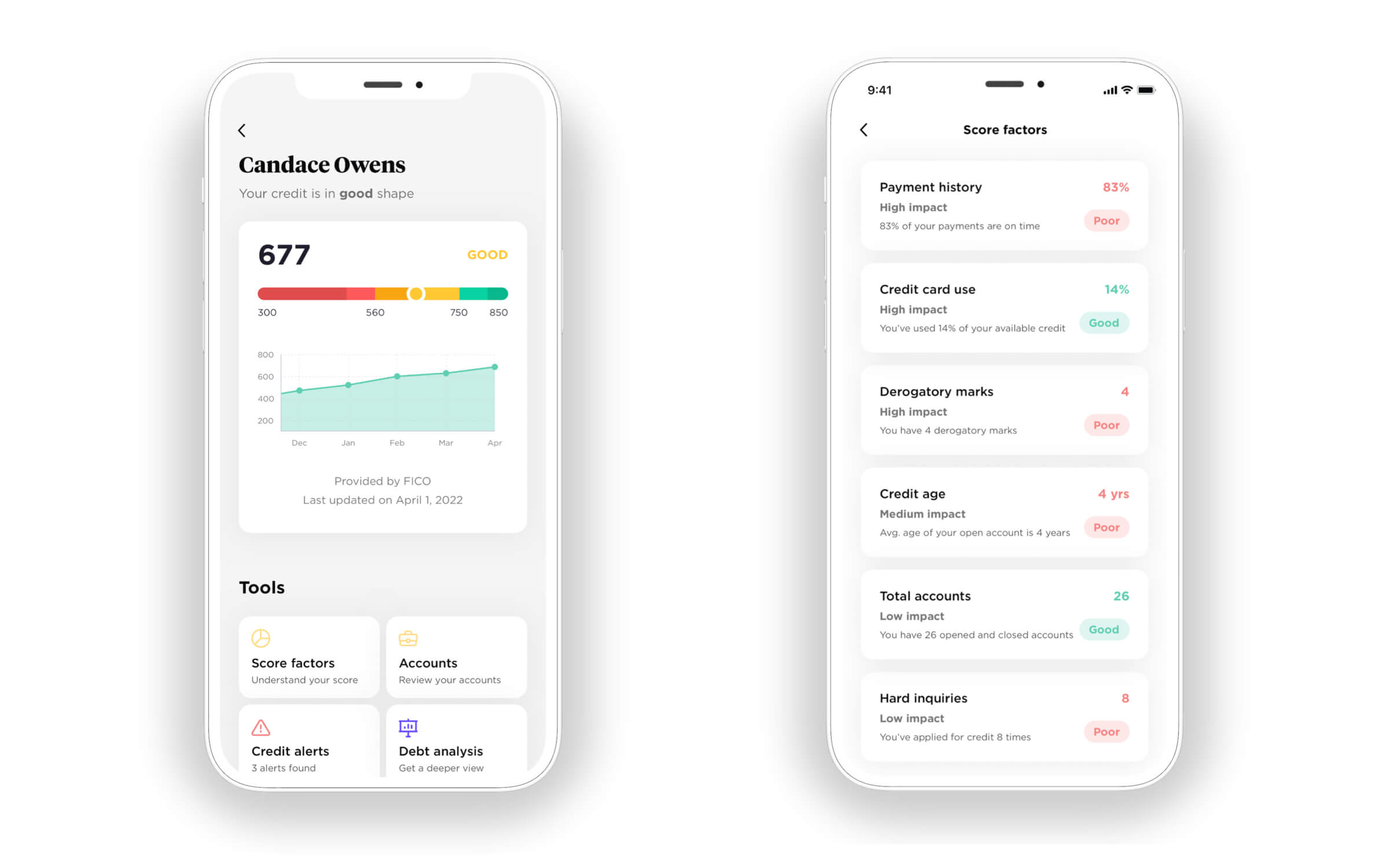

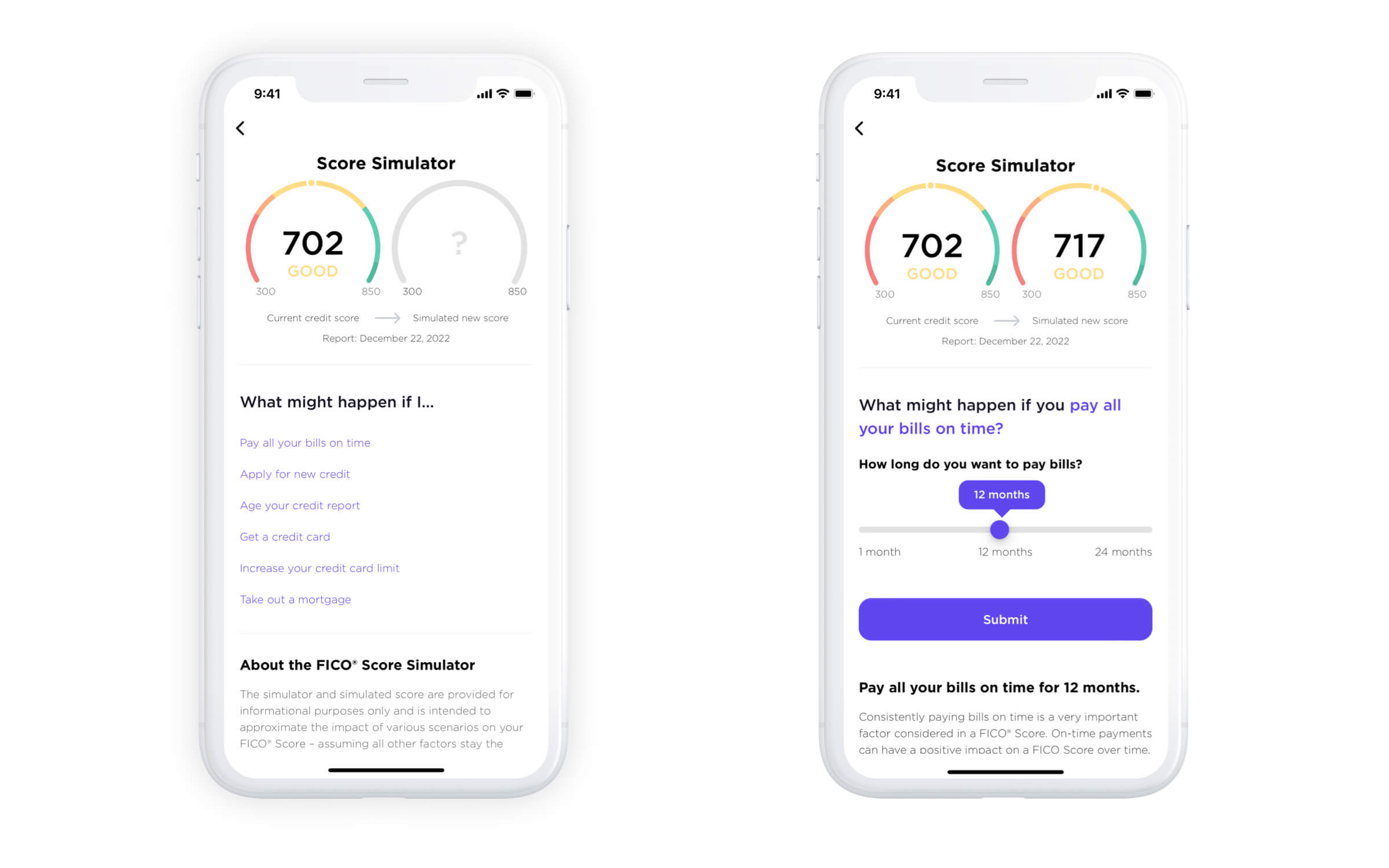

What’s your mortgage credit score? Find out by downloading the Gravy app and starting a free 7-day trial of Gravy+. We’ll show you a breakdown of the factors impacting your mortgage credit score and offer personalized suggestions for how to build your credit to get mortgage-ready.

How much does your credit score really matter when buying a house?

Credit matters – but there are two other factors that matter just as much.

- Your income: how much do you make and how does that relate to your debts?

- Your equity: how much do you have saved for a down payment?

Together, these three factors make up the lender criteria known as “ICE” – income, credit, equity. That’s the combination your future lender is looking at when they evaluate you as a borrower.

If your credit isn’t so good, you can make up the difference in the other two areas to get qualified.

The biggest thing you should know if you have bad credit but are applying for a mortgage anyway is this: it’s going to cost you.

Better credit means better interest rates, and over the life of the loan, this adds up.

However, think about this: most people move in less than 10 years, and folks who purchase a starter home may move even sooner.

You can also refinance into a better interest rate mortgage if your credit goes up and rates go down. Unlike paying rent, making mortgage payments on time will drastically affect your credit in a positive way.

The bottom line is if you can get qualified with bad credit, you can afford the mortgage, and you’re ready to be a homeowner: buy now.

Step #1: Get some quick credit score wins

Here are three strategies to get an almost instant boost to your score:

Reduce credit card utilization rate

Your credit utilization rate is the amount of money you have charged to the card divided by the total credit limit. This is a major factor in how your credit score is calculated.

Let’s say you have a total credit limit of $10,000. Paying down your balance from $5,000 to $2,500 changes your credit utilization rate from 50% to 25%. Your score goes up when you keep your credit utilization rate below 30%. Plus, you’ll save on interest payments, which aren’t cheap!

Request a higher credit limit

Have you consistently paid your credit card bill on-time, all the time? Instead of scraping together cash to pay down your credit card to get to that lower utilization rate, you could take the opposite approach: request a credit limit increase.

Credit card companies are more likely to grant this if you’ve had an increase in income and you have a history of responsible usage and on-time bill pay.

Get added to a healthy credit account

Some people ask parents or partners to add them to a credit card account that’s in good standing, with a low utilization rate, as an authorized user. This is another quick way to give your score a boost.

Step #2: Round out your mortgage application

Before you apply with a lender, consider adding a co-signer with a higher credit score. Certain lenders will use an average of two scores between both applicants.

However, keep in mind that every lender is different. Some lenders always use the lower score, so it may not help. Regardless, a co-signer does help with the “income” portion of the ICE equation, which can make up for shortcomings in the “credit” department.

You can also boost the “equity” side of the ICE equation by applying for a down payment assistance program to increase your available cash. Bigger down payments work in your favor in the underwriting process.

Here’s everything you need to know about down payment assistance – how to get it, who’s eligible, and more.

Step #3: Talk to a lender

You’re never going to know exactly how the numbers shake out for you until you apply with a lender, which is really a stress free consultation to see what you can afford. Ready to take the next step? Download Gravy to get connected with a top-rated lender that specializes in first-time homebuyer applications.

Buying with bad credit > waiting for better credit

It can take 7 years for some items to roll off your credit report. That’s seven years of potential home appreciation, equity, and wealth-building you would miss out on. Not to mention the rent hikes you’d contend with at the same time.

At the end of the day, the point of a credit score is to help you borrow. So if you can borrow sooner, you should do it.

And Gravy can help you get there faster.

.jpg)